We will try to tell you about B-Skat in an easy way below, along with practical examples.

What is B-Skat ?

B-skat is a type of tax you pay if you have an income called B-indkomst.

B-Skat In the case of a sole proprietorship:

- ➤ is calculated based on the company's projected profit (or loss) for the calendar year,

- ➤ you pay the tax yourself usually in 10 installments per year (except June and December) by the 20th of each month,

- ➤ you can set up Betalingsservice payments, so that B-skat tax is paid automatically every month (more later in this article),

How (and whether) to set the B-skat?

If you are running a business and expect to achieve in a given fiscal year profit, it is worthwhile to set the so-called. B-skat in your tax card (Danish forskudsopgørelse).

What does this mean in practice?

Let's assume that you have a sole proprietorship and your only source of income is payouts from that business. You estimate that in a year you will earn DKK 200,000. The Danish tax authority (SKAT) will calculate your tax on this basis - for example. DKK 60,000 For the whole year.

This amount will be divided into 10 equal installments, meaning that every month you will pay after 6,000 DKK.

This way you don't have to pay all the tax at once on your annual return, but instead spread it out in installments - and avoid financial shock 😊.

This projected profit you can change at any time In his tax card.

For example:

In July, your company got more orders than you expected, so now you're assuming you'll earn as much as DKK 400,000 instead of DKK 200,000.

In such a situation you update the data in the tax card, and the office recalculates the new tax amount. From subsequent months, your B-skat installments may increase - for example, to 15,200 DKK per month, to keep up with the new profit forecast.

How does it look at the annual settlement?

Let's assume that at the end of the year you find that you have earned a 450,000 DKK, but for a whole year you paid tax only on the DKK 400,000.

If this is the case, you will have to pay extra tax on the missing tax on your annual return DKK 50,000 - The tax office will simply make up the difference.

How to pay B-Skat ?

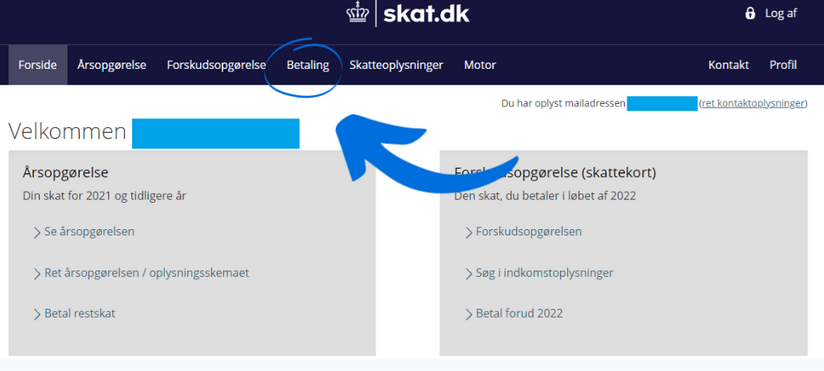

- All you have to do is log in personally to the skat.dk website via MitID and then select the “Betaling” tab.”

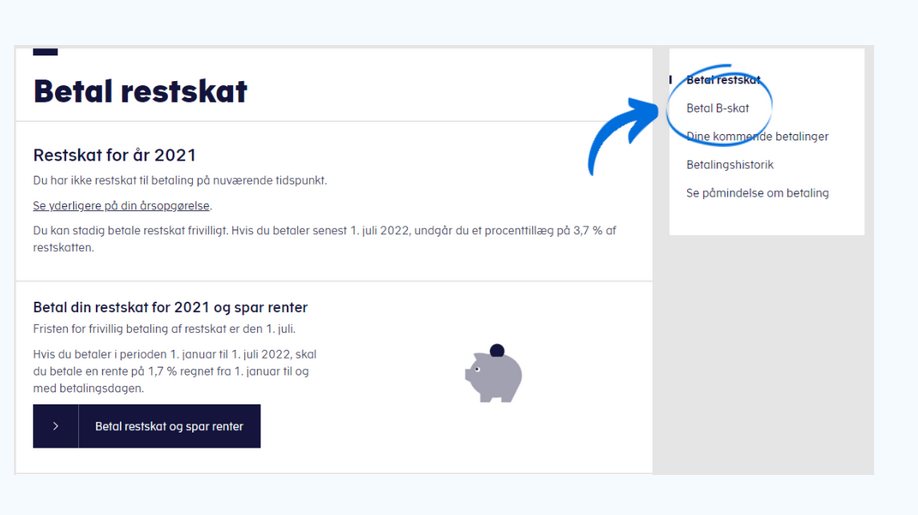

- Then click the „Betalt B-skat” button.

You will see information on when, how many and what codes to use for payment .

Use Betalingsservice, which automatically collects payments from your account on the appropriate dates thanks to which you can avoid unnecessary interest. In extreme cases, the authority may impose additional penalties, and non-payment may lead to legal problems.

What is the difference between A-skat and B-skat tax?

The general difference is that when you are employed as an employee and receive a salary from your employer, you pay A-skat tax on your salary.

In the case of sole proprietorships, this tax is called B-tax and is calculated on the company's profit.

As a self-employed person, you do not have to pay yourself a salary. The money you earn is your -profit and is considered your „salary.” However, in the case of a sole proprietorship, you must pay B-skat on the profit on an ongoing basis, since it is taxed as personal income.

Do you need help ?

Not sure where to start? Need more information or advice?

📞 Call us: +45 35 13 13 10 (Mon-Fri, 8:00am-6:00pm)

📧 Write: helpy@your-adviser.dk